InvestCapitalize Accelerate

India's Most Trusted Business Opportunity Platform for Buyers and Investors.

Create your Profiles and post your requirement to an Investor or to a Business Buyer. You may also sell Industrial Properties, Plant and Equipment or you may raise funds from Financial Institutions and NBFCs.

View All BusinessFull Sale

Jublehills,Hyderabad

Full Sale

Vijaya Nagar Colony ,Hyderabad

Full Sale

SOLD OUT

Hyderabad

Partial Sale

SOLD OUT

Hyderabad

Full Sale

SOLD OUT

Hyderabad

Full Sale

SOLD OUT

hyderabad

Business Owner / Director

Running Business

Hyderabad

Business Owner / Director

Hyderabad

Business Owner / Director

Running Business

Hyderabad

Business Owner / Director

Running Business

Hyderabad

Business Owner / Director

Array

Hyderabad

Business Owner / Director

Hyderabad

Create profile to explore Business opportunities. You may Find Profiles of Corporates, Individuals, Startups and Bank properties.

View All InvestorsPost your investment requirement for your business to an investor or to a banker. You may also ask for an investment from NBFC’s and Private Financiers.

View All Business

Hyderabad

Jadcherla

Hyderabad

Rent/ lease

Shamshabad near to Shamshabad airport north-gate.

Old

Andra Pradesh

Old

hyd

Old

hyd

Old

hyd

Old

hyd

Register to explore Genuine Property Owners and Quality Business Brokers in MSME DEALS who are Professionals in advising and Dealing ASSETS of Industrial, Warehouses and Machinery - Plant & Equipment for a SALE and LEASE.

View All Assets

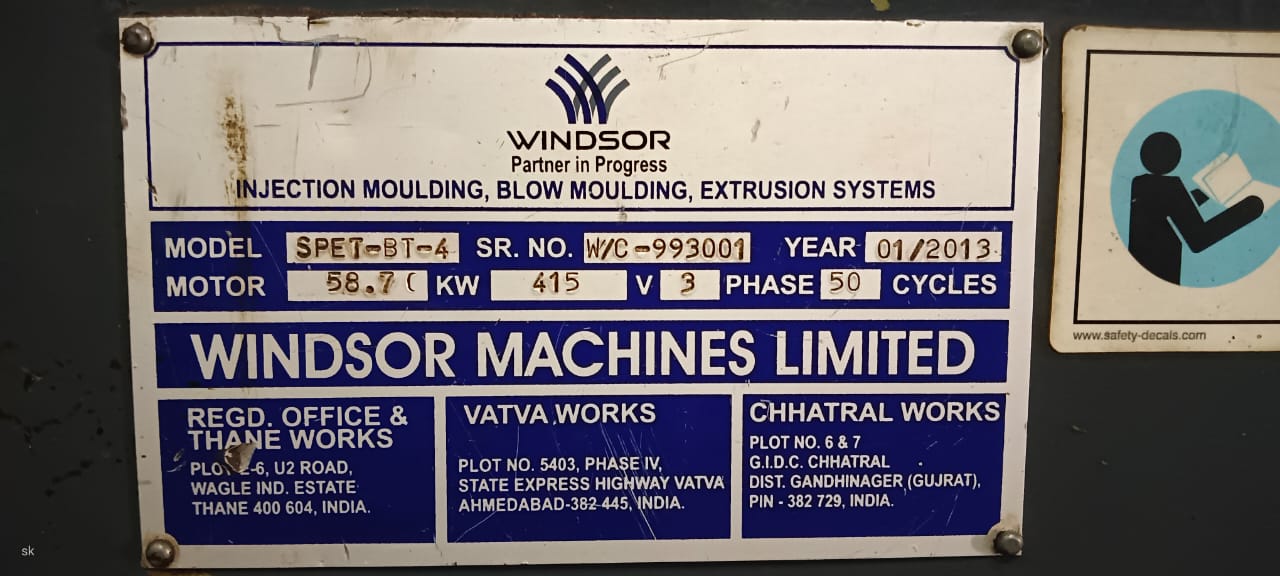

Notebook manufacturing unit for sale in Hyderabad.

MSME Deals is a market place to SELL or BUY Existing Businesses. Investors who wants to multiply investments in short span can invest in profitable and proven businesses. Our expert team will assist you to right valuations of your business and find the right buyer. Our execute team will assist the entrepreneurs in right valuation and find the right buyer or inestor. We also help you in legal documentation and raise funds through Banks/ NBFC