Home Loan

A home loan, also known as a housing loan, is a type of loan provided by financial institutions, such as banks and housing finance companies, to individuals who want to purchase or construct a home. Home loans are specifically designed to help individuals buy a house, apartment, or plot of land, or to construct a house on a plot they already own.

Benefits:

Tax Benefits: Home loan borrowers can claim tax deductions on interest and principal repayments.

Low Interest Rates: Home loan interest rates are generally lower compared to other types of loans.

Long Repayment Tenure: Home Loan repayment, also known as Home Loan foreclosure, is when a borrower repays the full outstanding loan amount in a single payment instead of opting for EMIs. It is part of the Home Loan process wherein the borrower can pay off the loan before the expiry of the tenor.

Pre-closer charges: There are no pre-closure charges applicable for home loan. You can close whenever you have funds to close the home loan.

Balance transfer facility: The current home loan interest rate may be overwhelming, or you may not be happy with your current lender’s service; you can transfer the home loan’s outstanding balance to a different lender who offers a lower interest rate and better service. Upon transfer, you can even check out the possibilities of a top-up loan on your existing one.

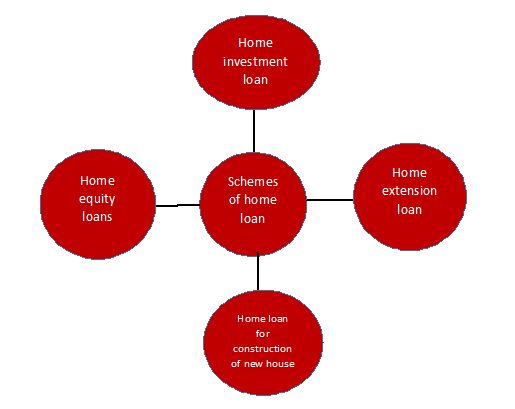

Home Construction Loan: This is the right home loan type if you already have a plot of land and you need financing to construct a house in that land.

Home Extension Loan : Say you already own a house and you would like to extend the house with another room or another floor to accommodate the growing family. Home extension loan provides financing for this purpose.

Home Equity loan: is a type of loan that allows homeowners to borrow money using the equity in their home as collateral. It is often called a second mortgage because it is separate from the primary mortgage used to purchase the home.

Interest Rates: The average home loan interest rates are from 6.5% to 12.00% in India as of March 2021. The rates usually vary from lender to lender, RBI-prescribed repo rate, inflation, economic activities, and many other factors.

At the beginning, lenders will assess your eligibility for home loan on the basis of your income and repayment capacity. The other important considerations include age, qualification, financial position, number of defendants, spouse's income and job stability.

Conclusion: Purchasing a house is a big step, it is also the most satisfying experience you will have in life. A home loan is one of the best ways to help you own home.